Business car depreciation calculator

D i C R i. Rental property depreciation calculator.

Depreciation Rate Formula Examples How To Calculate

C is the original purchase price or basis of an asset.

. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. Business vehicle depreciation calculator. Use this depreciation calculator to forecast the value loss for a new or used car.

Straight line depreciation calculator. Gas repairs oil insurance registration and of course. Suppose that you use a business vehicle 100 of.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. If you leave the. Chevrolet 55 average 3 year depreciation.

Where Di is the depreciation in year i. You Get the Best Offer In Seconds. Any business owner who uses a vehicle as part of their commercial operation is.

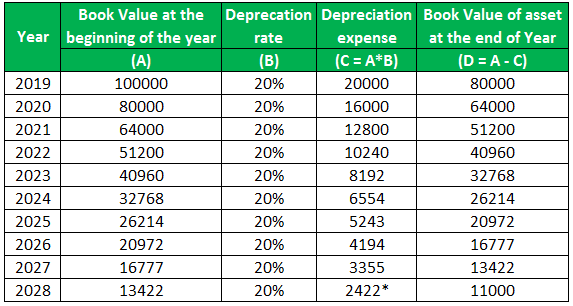

The car depreciation calculator will reflect the cars initial value in this case over 20500 if you enter the value into the 3 years box. Year 1 20 of the cost. Car depreciation or decline in value is the cost of the vehicle spread over its effective life.

The tool includes updates to. Under this method the calculation of depreciation is based on the fixed percentage of its cost. Our Resources Can Help You Decide Between Taxable Vs.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. This calculator is for illustrative and educational purposes. Ad Thousands of Dealers Bid on Your Car.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. To calculate your deduction multiply the number of. According to the general rule you calculate depreciation over a six-year span as follows.

The MACRS Depreciation Calculator uses the following basic formula. Citroen 45 average 3 year depreciation. We will even custom tailor the results based upon just a few of.

To put it in perspective brand new automobile costs. Ad Small Business Valuation Is Your Business Worth Selling Let ExitGuide Help. Get an Instant Offer for Your Car.

510 Business Use of Car. Chrysler 50 average 3 year depreciation. Dacia 25 average 3 year depreciation.

To compute business vehicle depreciation for the year you must multiply the basis amount by the percentage of business use of your vehicle. By entering a few details such as price vehicle age and usage and time of your ownership we. Before you use this tool.

Years 4 and 5 1152. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

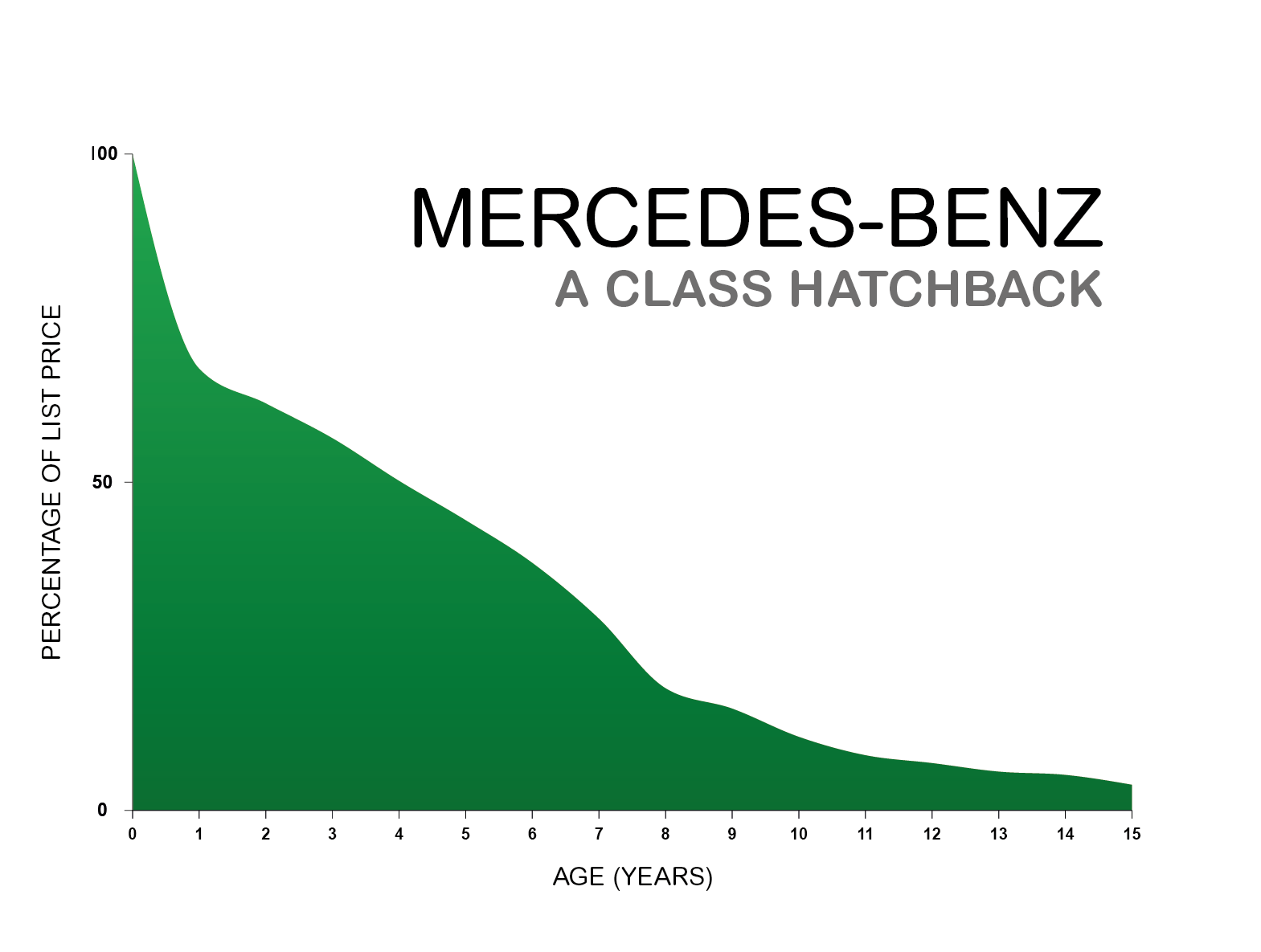

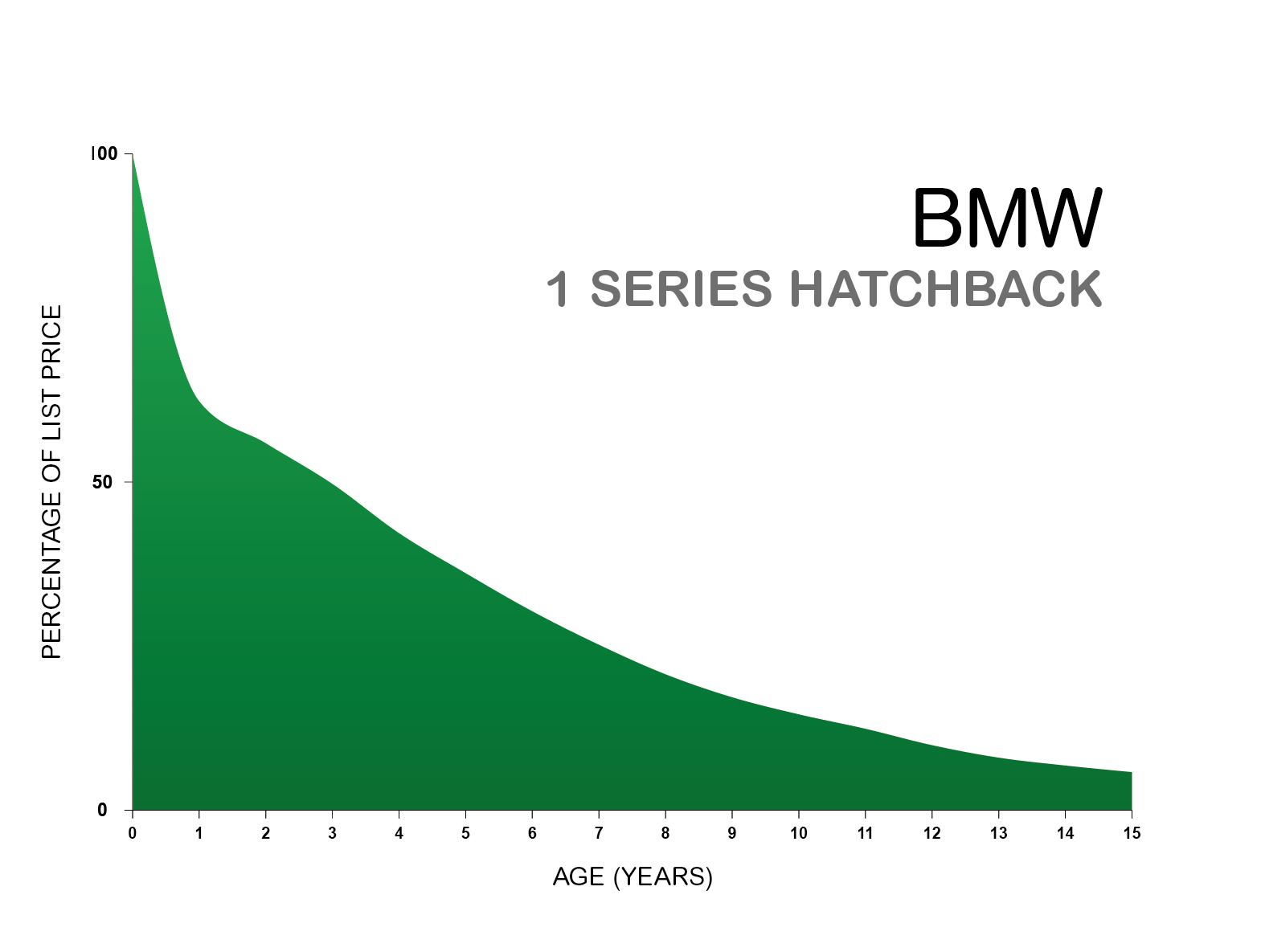

Cost of Running the Car x Days you owned 365 x 100 Effective life in years Lost Value. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1-year old etc. For instance a widget-making machine is said to depreciate. Its Free 100 Online And Includes Pickup.

Ways to Value A Small Business Learn What Approach Is Best For Your Business. In 2022 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the. Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years.

Download Depreciation Calculator Excel Template Exceldatapro

Automobile And Taxi Depreciation Calculation Depreciation Guru

Depreciation Calculator

Car Depreciation Explained With Charts Webuyanycar

Depreciation Calculator Definition Formula

Annual Depreciation Of A New Car Find The Future Value Youtube

Car Depreciation Online Tool For Philippines Carsurvey

Car Depreciation Rate And Idv Calculator Mintwise

Car Depreciation Chart How Much Have You Lost Infographic New Cars Infographic Financial Tips

Depreciation Rate Formula Examples How To Calculate

Car Depreciation Explained With Charts Webuyanycar

Car Depreciation How Much Value Have You Lost Masterpole Murphy Insurance Agency Syracuse Ny Independent Auto Home Life Business Insurance Agent

Car Depreciation Calculator

Free Macrs Depreciation Calculator For Excel

Awesome How Much Will A New Car Depreciate In 3 Years And View Best Quotes New Cars Bike Prices

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Depreciation Calculator Depreciation Of An Asset Car Property